Patelco also provides adaptable personal loan phrases and competitive fascination rates. Financial loan terms start out at just six months, which grants you use of the ideal curiosity prices. You may as well unfold your bank loan out above as much as seven decades for loans of $thirty,000 or even more, which helps minimize your monthly payment.

The origination rate, if included, is typically equal to 1% to 8% of the full amount of the loan. It's a processing or administrative price that is usually deducted upfront from the total quantity you might be borrowing.

We reviewed much more than 28 lenders that supply private loans to determine the general ideal six lenders having a credit score requirement at or under 640. To create our listing, lenders ought to offer you competitive once-a-year share costs (APRs). From there, we prioritize lenders determined by the next things:

While payday loans don’t require a credit check, they do generally come with triple-digit APRs and limited repayment periods. As it could be simple to roll over your original payday loan right into a new just one, you could potentially get stuck within an infinite cycle of debt that’s difficult to flee.

Like other credit unions, APRs max at eighteen%, 50 % of what quite a few banking companies and various lenders provide. Mortgage phrases prolong around 84 months, which might assist retain regular payments economical.

Except for Assembly Upstart’s minimum credit score necessity, probable borrowers will even have to meet the following criteria:

When picking an unexpected emergency financial loan for negative credit, some elements to consider involve the amount the bank loan will Expense, the repayment terms you can get (which is able to ascertain your regular payment), And the way rapidly you can utilize and have funded. The amount of the emergency personal loan will Value: The cost of an unexpected emergency loan is built up on the curiosity amount you’re charged and also the costs you’ll pay back to find the financial loan.

Examining your credit: While you may perhaps presently know your credit demands some get the job done, realizing your rating will let you weed out personalized personal loan lenders whose credit demands you aren't very likely to meet up with.

Credit score of three hundred on at least 1 credit report (but will settle for applicants whose credit history is so insufficient they don't have a credit score)

At CNBC Decide on, our mission is to deliver our readers with significant-excellent service journalism and thorough shopper guidance to allow them to make knowledgeable conclusions with their cash. Each and every particular financial loan listing is predicated on arduous reporting by our group of expert writers and editors with extensive expertise in mortgage products and solutions.

OppLoans might be really worth contemplating for borrowers with very poor credit who is probably not able to qualify for an additional personalized financial loan. Compared with most lenders, OppLoans doesn’t rely on your creditworthiness to generate a lending choice.

We checked out charges, fascination rates and versatile repayment options for various credit scores to discover the ideal undesirable credit individual loans.

Using private loans responsibly, for example by well timed repayments, is usually a strategic more info move in the direction of bettering one particular’s credit rating, demonstrating to creditors the capability to control and repay credit card debt correctly.

When you have terrible credit, then LightStream may not be the lender to suit your needs. If they're the lender for yourself, Then you can certainly take pleasure in zero expenses and lower APRs than what other lenders supply.

Jennifer Grey Then & Now!

Jennifer Grey Then & Now! Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Tina Majorino Then & Now!

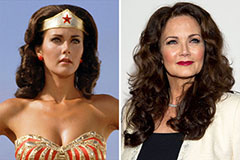

Tina Majorino Then & Now! Lynda Carter Then & Now!

Lynda Carter Then & Now! Melissa Sue Anderson Then & Now!

Melissa Sue Anderson Then & Now!